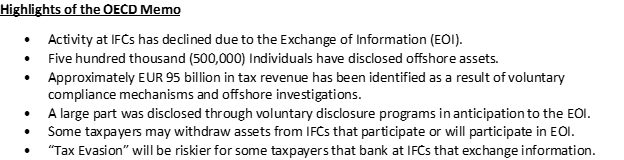

On June 7, 2019, the Organisation for Economic Co-operation and Development (OECD) released a Memo which is a “summary of ongoing work to assess the impact of increasing tax transparency and exchange of information (EOI) on cross-border financial activity using international investment data”. The publication’s headline conclusion is that deposits in International Financial Centres (IFCs) decreased by USD 551 billion or 34% by the first quarter of 2018 from a peak of USD 1.6 trillion in 2008. The decrease in deposits at IFCs is perceived in the Memo as a strengthening of tax compliance. The OECD states in the Memo that between 20% and 25% of the decrease is attributed to “information exchanges” under the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA).

Jurisdictions historically associated with Offshore activity are known as IFCs

According to the Memo, an IFC is a “controversial subject”. Nonetheless, these banking centers are known for: international banking, a specialty in insurance activity, or fund activity, or banking activity. For purposes of the OECD Memo, the jurisdictions analyzed were:

- Andorra,

- Anguilla,

- Antigua and Barbuda,

- Aruba,

- Bahamas,

- Bahrain,

- Barbados,

- Belize,

- Bermuda,

- BVI,

- Cayman Islands,

- Cook Islands,

- Costa Rica,

- Curacao,

- Cyprus,

- Dominica,

- Gibraltar,

- Grenada,

- Guatemala,

- Guernsey,

- Hong Kong,

- Isle of Man, Jersey,

- Lebanon,

- Liechtenstein,

- Luxembourg,

- Macau,

- Malaysia,

- Malta,

- Marshall Islands,

- Mauritius,

- Monaco,

- Montserrat,

- Nauru,

- Niue,

- Palau,

- Panama,

- Saint Kitts and Nevis,

- Saint Lucia,

- Saint Vincent and the Grenadines,

- Samoa,

- San Marino,

- Seychelles,

- Singapore,

- Switzerland,

- Turks and Caicos Islands,

- United Arab Emirates,

- Uruguay, and

- Vanuatu.

EOI equals Tax Compliance?

The decrease in deposits in IFCs is perceived by the OECD as support for the proposition that the amount of hidden offshore wealth is decreasing. According to OECD Secretary-General Angel Gurria, “Even more tax revenue is expected as countries continue to process the information received through data-matching and other investigation tools. We really are moving closer to a world where there is nowhere left to hide.”

Don’t be a Victim of your Own Making

Changes in the global tax environment make it challenging to remain tax non-compliant. Offshore hidden wealth could become a concept of the past based on EOI programs such as CRS and FATCA. Taxpayers that are tax non-compliant ought to consult with a specialized tax advisor.